Scan to Download

Instant Fast Loan Online is a powerful app that provides quick and flexible personal loans in India. Users can apply for loans ranging from Rs 10,000 to Rs 25,00,000, with fast approval and direct money transfers within minutes. The app also features a loan EMI calculator, multiple repayment options, and a fully online process for ultimate convenience.

In today's fast-paced world, the need for immediate financial solutions is more crucial than ever. The Instant Fast Loan Online app has emerged as a leading platform in India, offering swift and flexible private loan options. With over a million users already benefiting from its services, this app stands out for its efficiency and ease of use. This comprehensive guide explores the app’s features, loan options, and the process of obtaining a loan, providing a clear picture of how it can meet your financial needs.

Seamless Comparison and Calculation Tools

1. Compare Multiple Loan Options

One of the standout features of the Instant Fast Loan Online app is its ability to compare multiple loan options. Users can easily evaluate various loan apps to find the best rates and terms that suit their needs. The app includes a loan EMI (Equated Monthly Installment) calculator, which helps in assessing different repayment plans and understanding the total cost of borrowing. This feature is invaluable for making informed financial decisions and selecting the most suitable loan product.

2. Plan for Different Loan Amounts

The app offers flexible loan amounts ranging from Rs 10,000 to Rs 25,00,000. Whether you need a small personal loan or a larger sum for significant expenses, the Instant Fast Loan Online app accommodates various financial requirements. Users can plan and adjust their loan amounts based on their needs and financial capabilities, ensuring that they secure an amount that aligns with their financial goals.

3. Explore Various Repayment Methods

Repayment flexibility is a key aspect of the app. It offers different repayment options, allowing users to choose the method that best fits their budget and financial situation. This flexibility ensures that borrowers can manage their repayments comfortably, reducing the stress of meeting financial obligations.

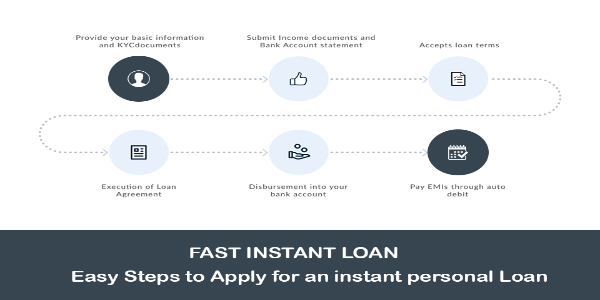

1. 100% Online Loan Process

The Instant Fast Loan Online app streamlines the entire loan application process, making it entirely online. This eliminates the need for physical paperwork and visits to banks or financial institutions. Users can complete their loan applications, submit required documents, and track their loan status all from their mobile devices.

2. Quick Loan Disbursal

One of the app’s most notable features is its rapid loan disbursal process. Once your loan is authorized, the money is transferred directly to your account within minutes. This fast processing time ensures that you receive the funds you need without unnecessary delays, making it ideal for urgent financial needs.

Tailored Loan Solutions

1. Eligibility and Loan Amounts

Loans available through the Instant Fast Loan Online app range from Rs 10,000 to Rs 25,00,000. The interest rates vary from 0% to 14.95% per year, depending on the borrower’s credit profile and loan type. The app supports various loan durations, from 90 days to 5 years, providing flexibility in repayment.

2. Immediate Loan Approval

The app promises immediate loan eligibility, with approval and money transfer often occurring in under 15 minutes. This swift process is designed to meet the urgent financial needs of users, offering a hassle-free experience from enrollment to fund disbursement.

3. Diverse Loan Categories

Instant Fast Loan Online caters to different loan categories, including online order EMI loans for various purchases such as electronics, travel, and more. This diversity ensures that users can find a loan that fits their specific requirements and financial plans.

1. Trusted Lenders

The app ensures transparency by connecting users with lenders from RBI-certified finance companies. This commitment to honesty and reliability guarantees that users are dealing with reputable financial institutions.

2. Floating Interest Rates

Interest rates on loans are variable, ranging from 0% to 17.35% per year. The floating rates are influenced by market conditions, and the app provides clear information about the applicable rates to help users make informed decisions.

3. Top-Quality Loans for Different Needs

The app offers tailored loan products for various categories:

Personal Loans for Salaried Individuals: Require just a PAN card, address proof, and proof of salary. Example: A loan of Rs 1,00,000 over 12 months with an interest rate of 10% per annum would result in an EMI of Rs 11,746 and a total amount owed of Rs 1,11,162.

Personal Loans for Self-Employed Individuals: Loans ranging from Rs 70,000 to Rs 10 lakhs with repayment periods of 6 to 27 months. Only a PAN card and proof of residence are needed.

1. Download and Install the App

Begin by downloading the Instant Fast Loan Online app from your preferred app store and installing it on your device.

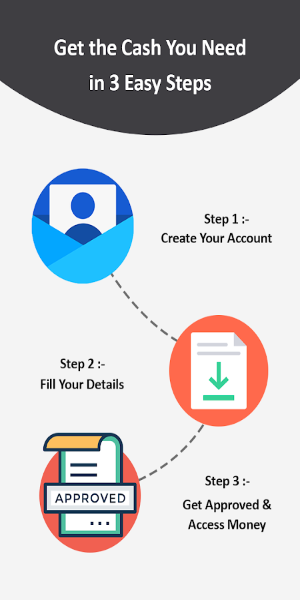

2. Create an Account

Create an account by filling out basic information to check your eligibility for a loan. This initial step helps in understanding your loan options and potential approval.

3. Submit KYC Documents

Attach necessary Know Your Customer (KYC) documents, including your ID, proof of address, and PAN card. These documents are required for identity verification and loan processing.

4. Request a Loan

Once your documents are verified, you can request a money transfer or an E-voucher for your loan. The app facilitates a smooth transition from application to fund disbursement.

Service Charges and Interest Rates

1. Interest Rates and Fees

The app’s interest rates range from 0% to 12.95% per month, with a comparable monthly interest rate of 0% to 2.49%. Service charges vary based on the risk profile of the borrower:

Low-Risk Customers: Charged between 0% and 3%.

High-Risk Customers: Fees range from 2.5% to 7%.

2. Annual Fees

Annual fees for personal loans range from 0% to 18% for low-risk clients and 9% to 15% for standard customers. High-risk customers may incur fees ranging from 12% to 21%, and those with very high risk levels may face fees from 20% to 50%.

The Instant Fast Loan Online app revolutionizes the way you access and manage loans, providing a fast, flexible, and fully online experience. With a range of loan options, swift disbursal, and user-friendly features, the app is designed to meet diverse financial needs efficiently. Embrace the convenience and speed of Instant Fast Loan Online and take control of your financial future today.

File size: 18.86 M Latest Version: v1.0.8

Requirements: Android Language: English

Votes: 100 Package ID: com.sparkleappsstore.fastloan.instantdigitalloan.d

Developer: Sparkle Apps Store

Level up your phone with the most helpful tools for Ultimate productivity. From image editors and file managers to task trackers and weather widgets, these top-rated essentials make everyday tasks smooth and easy. Get organized, save time and optimize workflows with a powerful toolbox by downloading these editor's choice utilities today. Your phone will never be the same again!

Comment