Scan to Download

Loans & Interests Simulator is a versatile app that allows users to easily calculate loan payments, interest rates, and total costs. With features like payment reminders, graphical data visualization, and amortization tables, it helps manage personal, student, mortgage, business, and auto loans efficiently. Available offline and in multiple languages, it’s an essential tool for financial management.

Managing loans and credit can be a daunting task, especially when it comes to understanding how much you need to pay and keeping track of multiple payments. The Loans & Interests Simulator is a powerful and user-friendly tool designed to simplify this process. Whether you’re dealing with personal loans, student loans, mortgages, business loans, or auto loans, this simulator provides you with all the necessary tools to effectively manage and calculate your loan payments.

1. Comprehensive Loan Calculations

The Loans & Interests Simulator allows you to calculate various loan parameters with ease. You can input any variable related to your loan, such as the interest rate, monthly payment, loan duration, or loan amount. Based on these inputs, the app provides you with critical information including:

-The total interest paid over the life of the loan

-The overall cost of credit

-Amortization schedules, showing how your payments are distributed between principal and interest over time

This feature ensures that you have a clear understanding of your loan’s financial impact, helping you make informed decisions about your borrowing.

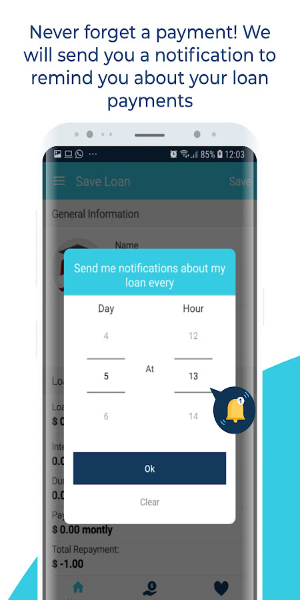

2. Payment Reminders

Keeping track of due dates for multiple loans can be challenging. The Loans & Interests Simulator tackles this issue by offering monthly payment reminders. You’ll receive notifications about your upcoming payments, reducing the risk of missed payments and potential late fees. This feature is particularly useful for managing various types of loans and ensuring that your finances remain in order.

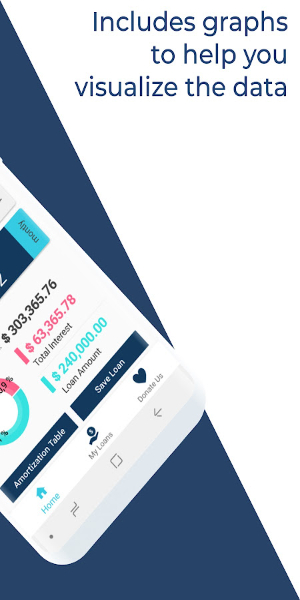

3. Visual Data Representation

Understanding complex financial data can be difficult. The app includes graphical representations of your loan data, making it easier to visualize and comprehend. Graphs provide a clear view of your payment schedule and how your loan balance decreases over time. This visual approach helps you grasp the long-term effects of your loan more intuitively.

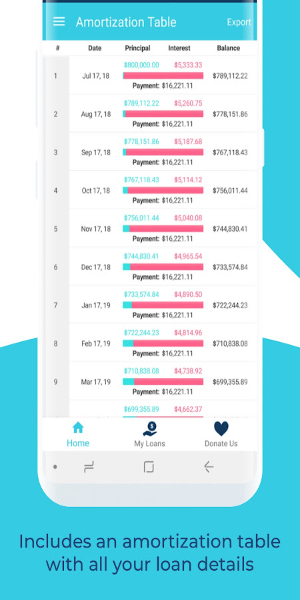

4. Amortization Tables

For those who prefer detailed financial breakdowns, the simulator provides an amortization table. This table outlines all your loan details, showing the distribution of payments between principal and interest over the life of the loan. It’s a valuable tool for anyone looking to understand the intricacies of their loan repayment process.

5. Export and Sharing Options

The app allows you to store, email, or share your loan history. This feature is particularly useful for keeping track of your financial records and sharing important loan information with financial advisors or family members. It enhances the app’s functionality by integrating seamlessly into your financial management routine.

6. User-Friendly Design

Ease of use is a core focus of the Loans & Interests Simulator. The app boasts a highly functional design that is both easy to read and intuitive. Its simple interface ensures that even users with minimal technical skills can navigate and utilize its features effectively. Calculations are performed quickly, providing you with results in a matter of seconds.

7. Multi-Language Support

The app is designed to cater to a diverse user base with its multi-language support. This feature makes the simulator accessible to users from different linguistic backgrounds, enhancing its usability and appeal on a global scale.

8. Offline Functionality

One of the standout features of the Loans & Interests Simulator is its offline capability. The app does not require an internet connection to function, making it highly accessible regardless of your connectivity status. It is compatible with various devices and software versions, ensuring a wide range of users can benefit from its features.

9. Continuous Updates

The developers of the Loans & Interests Simulator are committed to keeping the app up-to-date with the latest features and improvements. Regular updates ensure that the app continues to meet user needs and incorporates new functionalities as they become available.

Whether you're consolidating debt or funding a personal project, the app helps you manage personal loans effectively. Calculate your payments and understand the impact of different loan terms and interest rates.

Student Loans

For students and graduates, the simulator provides essential tools for managing education-related debt. Plan your repayment strategy and visualize how different payment options affect your loan balance.

Mortgage Loans

Homebuyers can benefit from detailed mortgage calculations. The app helps you understand your monthly payments, interest costs, and amortization schedule, aiding in your home-buying decision process.

Business Loans

Entrepreneurs and business owners can use the app to manage loans for business purposes. Calculate the financial impact of different loan options and keep track of repayment schedules.

Auto Loans

For those financing a vehicle, the app provides tools to manage auto loans. Calculate your payments, track your loan balance, and ensure you’re prepared for all associated costs.

The Loans & Interests Simulator stands out as a comprehensive and user-friendly tool for managing various types of loans. With its robust set of features, including loan calculations, payment reminders, graphical data representation, amortization tables, and offline functionality, the app offers a complete solution for your loan management needs. Its commitment to continuous updates and multi-language support further enhances its value, making it a versatile tool for users worldwide. Whether you’re a student, homeowner, business owner, or car buyer, this simulator provides the necessary tools to effectively manage and understand your loans, ensuring financial clarity and peace of mind.

File size: 17.87 M Latest Version: v1.7.14

Requirements: Android Language: English

Votes: 100 Package ID: com.romerock.apps.utilities.loancalculator

Developer: Rome Rock App Studio

Level up your phone with the most helpful tools for Ultimate productivity. From image editors and file managers to task trackers and weather widgets, these top-rated essentials make everyday tasks smooth and easy. Get organized, save time and optimize workflows with a powerful toolbox by downloading these editor's choice utilities today. Your phone will never be the same again!

Comment