Scan to Download

Loan Simulator is a comprehensive app that helps users calculate their loan’s monthly fee, generate amortization schedules, and total the interest paid over the life of the loan. By providing detailed financial insights, users can make informed decisions, compare loan options, and manage their payments effectively, ensuring a clear understanding of their loan commitments.

Navigating the complexities of loan management can be challenging. With the Loan Simulator app, you gain a powerful ally in understanding and managing your loan costs. This detailed guide explores how the Loan Simulator simplifies financial planning, offering precise calculations and insightful projections to help you make informed decisions about your loans.

Empower Your Financial Decisions: How Loan Simulator Works

The Loan Simulator app is designed to take the guesswork out of loan management. By providing detailed calculations and projections, the app helps users evaluate their loan options and understand the long-term impact on their finances. Whether you’re considering a new loan or reviewing an existing one, Loan Simulator offers a comprehensive analysis of your loan's cost structure.

One of the standout features of Loan Simulator is its ability to calculate the monthly fee of your loan. By entering the loan amount, interest rate, and term, the app provides a clear picture of your monthly payments. This feature allows you to:

Budget Accurately: Understand your monthly financial commitments and plan your budget accordingly.

Compare Loan Options: Evaluate different loan offers to choose the one that best fits your financial situation.

Adjust Terms: Experiment with different loan terms and interest rates to see how changes affect your monthly payments.

This functionality ensures that you can make well-informed decisions and avoid surprises in your financial planning.

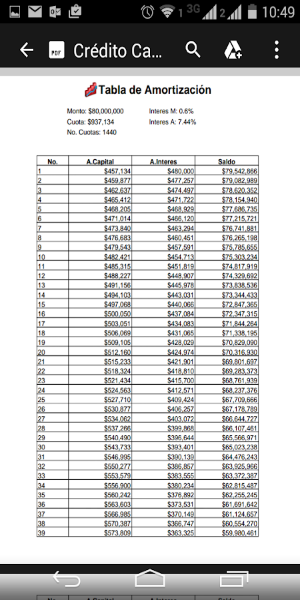

Amortization Schedule: Visualize Your Loan’s Progress

The Loan Simulator app also generates a detailed amortization schedule. This schedule breaks down each payment into principal and interest components, offering a clear view of how your loan balance decreases over time. Key benefits of the amortization feature include:

Track Payment Progress: See how much of each payment goes towards reducing your principal versus covering interest.

Understand Loan Lifespan: Gain insight into how long it will take to pay off your loan based on current terms.

Plan Ahead: Adjust your payment strategy if you wish to pay off your loan faster or need to understand how additional payments affect your balance.

By visualizing your loan’s progress, you can better manage your financial goals and make adjustments as needed.

Another critical feature of the Loan Simulator is its ability to total the interest paid over the life of the loan. This calculation helps you understand the true cost of borrowing. Here’s why this feature is essential:

Evaluate Total Cost: Determine how much you will spend in interest and how it compares to the loan principal.

Compare Loans: Assess the long-term cost of different loan options and choose the one with the most favorable terms.

Financial Planning: Use this information to make informed decisions about refinancing or paying off loans early.

Knowing the total interest paid enables you to make smarter financial choices and avoid potential pitfalls.

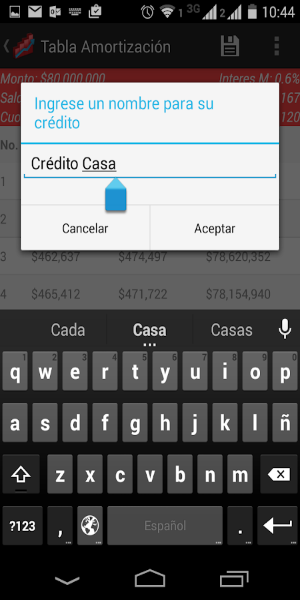

User-Friendly Experience: Seamless and Intuitive

Loan Simulator stands out for its user-friendly design and intuitive interface. The app’s layout is clean and straightforward, making it easy for users to input their loan details and obtain accurate results quickly. Features include:

Simple Navigation: Easily access different functions, such as monthly fee calculation, amortization scheduling, and interest totals.

Interactive Graphs: Visual representations of payment schedules and interest distribution enhance understanding.

Customizable Inputs: Adjust loan parameters to fit your specific needs and preferences.

The app’s design ensures that users of all experience levels can navigate the tool effortlessly and gain valuable insights into their loan management.

Practical Applications: When to Use Loan Simulator

The Loan Simulator app is useful in various financial scenarios:

Loan Shopping: Before committing to a new loan, use the app to compare different offers and choose the best one for your needs.

Financial Planning: Regularly check your loan’s progress and make adjustments to your payment strategy as necessary.

Refinancing Decisions: Evaluate the impact of refinancing options and determine if they align with your financial goals.

By incorporating Loan Simulator into your financial routine, you can manage your loans more effectively and make well-informed decisions.

In conclusion, the Loan Simulator app is an essential tool for anyone seeking to understand and manage their loan costs effectively. With its ability to calculate monthly fees, generate amortization schedules, and total interest paid, the app provides comprehensive insights into your loan’s financial impact. Whether you’re shopping for a new loan, managing an existing one, or considering refinancing, Loan Simulator offers the clarity and precision needed to make informed financial decisions.

Download Loan Simulator today and take control of your financial future with confidence and ease.

File size: 7.54 M Latest Version: v3.5

Requirements: Android Language: English

Votes: 89 Package ID: com.cristhian.calculadorcredito

Developer: Cristhian Salazar

Find deals, save money and satisfaction-guaranteed with the top shopping apps. Browse name brands, local stores and all your favorite categories - these editor-approved apps make it fun and easy. Compare prices, read reviews and get discounts with a few taps. Download now for a seamless mobile retail experience that helps you hunt down true bargains 24/7.

Comment